top of page

About Our Firm

Founded in 2019, MarketDesk provides financial advisors with a full suite of institutional tools that save time, strengthen your client experience, and enable growth without expanding your team. Our platform helps teams of all sizes build a world-class wealth management business.

Trusted by 200+ wealth management firms, our solutions integrate seamlessly into your practice, enabling you to deliver more to clients and operate with greater efficiency. Advisors using MarketDesk benefit from asset allocation tools, custom model portfolios, and client-friendly insights that bring simplicity and structure to their workflows. You retain complete control while gaining an independent partner committed to your long-term success.

Unlike most service providers, MarketDesk does not require advisors to hand over discretion or pay fees tied to assets. We offer a flat-fee subscription designed to align with your goals and support your firm's growth.

Our Services

Models, Research, & Client Insights

Client-Friendly Market Insights

Data-Driven Asset Allocation Tools

Who We Serve

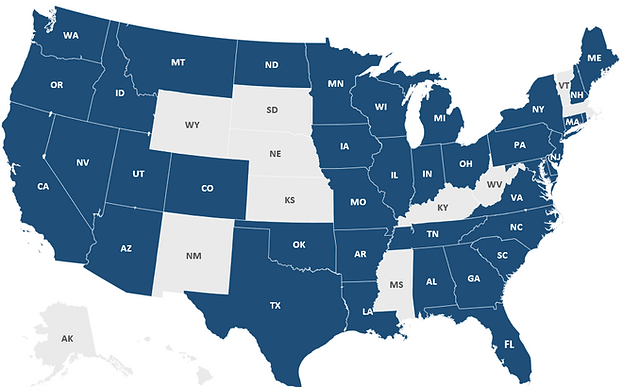

MarketDesk is trusted by 200+ wealth management firms in 41 states

200+

Firms Using MarketDesk Solutions

$135 Bn

Combined AUM of Firms Using MarketDesk

20+

Proprietary Leading Indicators

3

Robust Solutions Built for Financial Advisors

0.00%

No Asset Based Fees

Explore Our Services

Built for Financial Advisors

-

Client Chart Presentations

-

Prebuilt Webinars

-

Compliance Support

-

White Label Stock Models

-

Market Talking Points

-

20+ Leading Indicators

PLUS

bottom of page